Ride Correct Oscillation The relative strength index strategy

The RSI (Relative Strength Index) strategy is a popular and widely used approach in forex trading that leverages the principles of momentum and overbought/oversold conditions. The RSI indicator measures the magnitude of recent price changes to evaluate whether an asset is overbought (potentially due for a downward correction) or oversold (potentially due for an upward correction).

Here's a brief overview of the RSI strategy in forex trading:

Strategy Components:

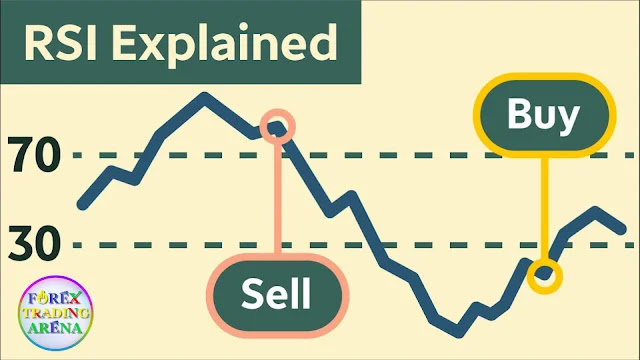

- RSI Indicator: The RSI is a momentum oscillator that ranges from 0 to 100. Values above a certain threshold (often 70) are considered overbought, while values below another threshold (often 30) are considered oversold.

- Overbought and Oversold Levels: Traders use the RSI levels of overbought (70) and oversold (30) as key decision points for potential trading opportunities.

- Entry Criteria: When the RSI crosses above the overbought threshold (70), it might suggest that the asset is overvalued and due for a downward correction. Conversely, when the RSI crosses below the oversold threshold (30), it might suggest that the asset is undervalued and due for an upward correction.

- Confirmation: Traders often use other technical indicators or analysis methods to confirm potential trades. These might include trendlines, support and resistance levels, and chart patterns that align with the RSI's overbought or oversold signals.

Strategy Implementation:

- Identify Overbought and Oversold Conditions: The RSI value is analyzed to determine whether it's above the overbought threshold (70) or below the oversold threshold (30).

- Entry Decision: When the RSI crosses above 70, traders might consider opening a sell position, anticipating a potential downward correction. When the RSI crosses below 30, traders might consider opening a buy position, anticipating a potential upward correction.

- Risk Management: As with any trading strategy, risk management is crucial. Traders should set stop loss orders to limit potential losses if the price moves against their position.

- Take Profit: Traders can set take profit levels based on their risk-to-reward preferences. The aim is to capitalize on the potential correction that aligns with the RSI's signal.

Benefits of RSI Strategy:

- Timely Entries: The RSI strategy helps traders identify potential reversals early in the process, allowing them to enter trades at the beginning of a potential price movement.

- Simplicity: The strategy is relatively simple and can be easily incorporated into trading decisions, even for novice traders.

Considerations:

- False Signals: Like any trading strategy, the RSI strategy can generate false signals, particularly in volatile or trending markets. Traders should use additional indicators or analysis methods for confirmation.

- Divergence: Traders should also watch for divergence between the RSI and price movements, as it can signal potential changes in momentum and trend direction.

Conclusion:

The RSI strategy offers traders a tool to gauge potential overbought and oversold conditions, aiming to capitalize on impending price corrections. By understanding the RSI indicator's signals and applying proper risk management practices, traders can effectively incorporate this strategy into their trading arsenal to navigate the forex market's dynamic landscape.

Let me explain the code for the RSI Strategy in detail:

strategy("RSI Strategy", overlay=true): This line initializes the strategy and sets the name of the strategy to "RSI Strategy". The overlay=true parameter ensures that the strategy is plotted on the main chart along with the price.

length = input(14): This line defines the length parameter for the RSI indicator. It allows you to customize the length of the RSI calculation. By default, it is set to 14.

overSold = input(30): This line defines the oversold level parameter for the RSI indicator. It determines the level at which the RSI is considered oversold. By default, it is set to 30.

overBought = input(70): This line defines the overbought level parameter for the RSI indicator. It determines the level at which the RSI is considered overbought. By default, it is set to 70.

price = close: This line sets the price variable to the closing price of the current bar.

vrsi = ta.rsi(price, length): This line calculates the RSI (Relative Strength Index) using the ta.rsi() function. It takes the price and length as parameters and returns the RSI value.

co = ta.crossover(vrsi, overSold): This line checks if the RSI value has crossed above the oversold level. The ta.crossover() function returns true if it crosses above, otherwise false.

cu = ta.crossunder(vrsi, overBought): This line checks if the RSI value has crossed below the overbought level. The ta.crossunder() function returns true if it crosses below, otherwise false.

if (not na(vrsi)): This line checks if the RSI value is not null. It ensures that the RSI value is available before executing any further logic.

if (co): This line checks if a crossover (RSI crossing above oversold level) has occurred.

strategy.entry("RsiLE", strategy.long, comment="RsiLE"): This line generates a long entry signal if the crossover condition is met. It opens a long position with the name "RsiLE".

if (cu): This line checks if a crossunder (RSI crossing below overbought level) has occurred.

strategy.entry("RsiSE", strategy.short, comment="RsiSE"): This line generates a short entry signal if the crossunder condition is met. It opens a short position with the name "RsiSE".

//plot(strategy.equity, title="equity", color=color.red, linewidth=2, style=plot.style_areabr): This line is a commented-out code that plots the equity curve of the strategy. You can uncomment it if you want to visualize the equity curve.

This strategy aims to generate trade signals based on the RSI indicator. It enters a long position when the RSI crosses above the oversold level and enters a short position when the RSI crosses below the overbought level.

Copypaste code to your Tradingview Strategy Tester

//@version=5

strategy("RSI Strategy", overlay=true)

length = input( 14 )

overSold = input( 30 )

overBought = input( 70 )

price = close

vrsi = ta.rsi(price, length)

co = ta.crossover(vrsi, overSold)

cu = ta.crossunder(vrsi, overBought)

if (not na(vrsi))

if (co)

strategy.entry("RsiLE", strategy.long, comment="RsiLE")

if (cu)

strategy.entry("RsiSE", strategy.short, comment="RsiSE")

//plot(strategy.equity, title="equity", color=color.red, linewidth=2, style=plot.style_areabr)

Copy this code to your MT4 Editor

//+------------------------------------------------------------------+

//| RSIStrategyEA |

//| Copyright 2023, YourNameHere |

//| http://www.yourwebsite.com |

//+------------------------------------------------------------------+

//| This Expert Advisor implements an RSI strategy with take profit |

//| and stop loss levels. |

//+------------------------------------------------------------------+

extern int RsiPeriod = 14; // Period for calculating RSI

extern int RsiOverbought = 70; // RSI overbought level

extern int RsiOversold = 30; // RSI oversold level

extern int TakeProfitPips = 50; // Take profit in pips

extern int StopLossPips = 30; // Stop loss in pips

//+------------------------------------------------------------------+

void OnStart()

{

double rsi = iRSI(Symbol(), Period(), RsiPeriod, PRICE_CLOSE, 0);

// Check for overbought and oversold conditions

if (rsi > RsiOverbought)

{

double entryPrice = Ask;

double takeProfitPrice = entryPrice - TakeProfitPips * Point;

double stopLossPrice = entryPrice + StopLossPips * Point;

int ticket = OrderSend(Symbol(), OP_SELL, 1, entryPrice, 2, stopLossPrice, takeProfitPrice, "RSI Sell", 0, clrNONE);

if (ticket > 0)

Print("Sell order opened at price:", entryPrice);

}

else if (rsi < RsiOversold)

{

double entryPrice = Bid;

double takeProfitPrice = entryPrice + TakeProfitPips * Point;

double stopLossPrice = entryPrice - StopLossPips * Point;

int ticket = OrderSend(Symbol(), OP_BUY, 1, entryPrice, 2, stopLossPrice, takeProfitPrice, "RSI Buy", 0, clrNONE);

if (ticket > 0)

Print("Buy order opened at price:", entryPrice);

}

}

//+------------------------------------------------------------------+

Posts you may Like !

- Robo Scanner How to Use 123 Reversal Pattern in Trading

- High success rate Ichimoku Cloud trading strategy

- Charting expertise with channel breakout strategy

- Trade like a pro using Bollinger Bands strategy

- Unlimited profits from advanced Trailing stop strategy

- How To Invest with Dollar Cost Averaging (DCA) strategy

- Expert Advisor based Most advanced Grid trading strategy that you dont know

- Capturing Market Strength Momentum Trading Strategy

- 5 Valuable Hedging Strategies For Forex Traders

- This AutoPilot Robo will Boost Your Account.

-modified.webp)

.webp)

No comments